“Do I have to book casual employees on the payroll?” is a question we’re asked a lot, especially by clients in hospitality and retail.

These two sectors are among the most likely to use casual employees, though they’re not alone in this. You’ll find casual employees in administration and a myriad of other roles, too.

You know what it’s like – you’ve got a busy weekend ahead with several large parties each night and need an extra pair of hands or two to manage the extra footfall. Or you’re heading up to Black Friday and know you’ll need all the help you can get. That’s where your casual workers become invaluable.

And yet we can see why people might be confused when it comes to payroll. Are you really expected you to jump through all those hoops for someone who’s only working with you for a few hours or days here and there? Unfortunately, the short answer is yes.

Who counts as a casual employee?

HMRC defines a ‘casual employee’ as someone taken on for no more than 1 week in a whole tax year. In this case, as long as they earn less than the PAYE threshold, you just need to keep a record of their name, address, and what you paid them. Simple, easy and nothing much to worry about. As long as they fit these criteria.

However, your own definition of a ‘casual employee’ is likely to be substantially different. The term probably makes you think of employees on zero-hours contracts, or anyone that may not know from one week to the next how many hours they’re likely to work, if any.

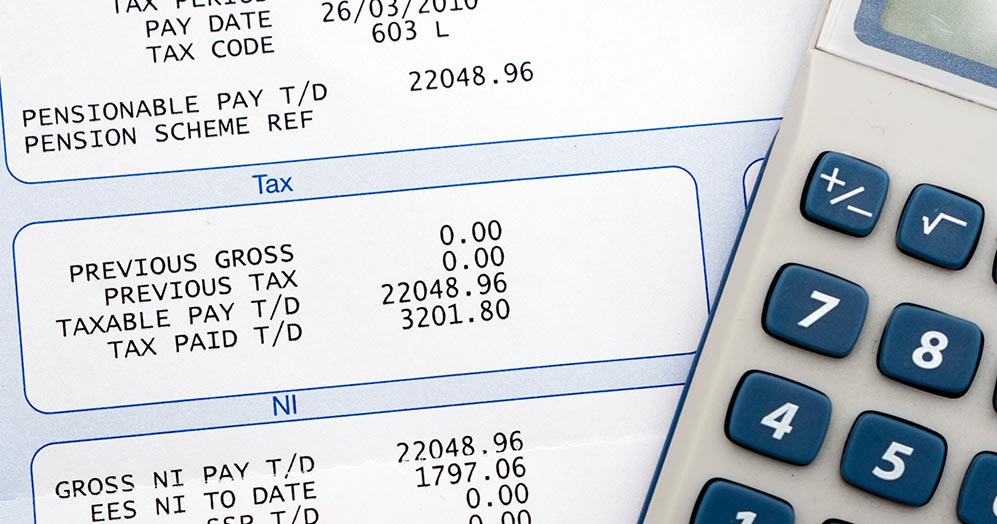

But as far as HMRC are concerned, these casual workers must be entered into the payroll system in the same way as a permanent employee as soon as their employment is confirmed. This ensures that the correct tax code is used, saving you the costly responsibility of making up the difference should there be an error.

Please note, you must always avoid paying casual workers cash in hand. This, too, could result in your liability for unexpected costs.

How a payroll service can help

Though this may sound like a lot of extra work, it doesn’t have to be. There are ways in which you can save yourself time and hassle, such as outsourcing your payroll using a specific service, like ours. This allows us to take payroll worries off your hands and leaves you to focus on the parts of your business you do best. Our expert team knows all the legal ins and outs of processing payroll, giving you peace of mind that you won’t be caught short.

Our payroll experts:

- Keep your payroll records secure

- Deduct employee tax, as well as other applicable deductions

- Work out total pay

- Make payments direct to your employees.

Make your life easier

So, if you’re feeling overwhelmed by payroll rules and queries, or just want to make your life easier, we can help. Simply contact us today to talk through the level of service you need, and we’ll get the ball rolling. And if you have queries about certain situations now or in the future, you can always get in touch for friendly, reassuring advice.

Take back control and ease your mind by outsourcing your payroll. Contact us today.